In 2025, I opened 7 credit cards and 18 bank accounts in search of their sign-up bonuses (aka churning). For my credit cards (both new and existing), I paid $1,855 in annual fees.

Churning in banking bonuses (primarily credit cards) means repeatedly opening new accounts to get sign-up bonuses (cash, points, miles)

– Google AI overview

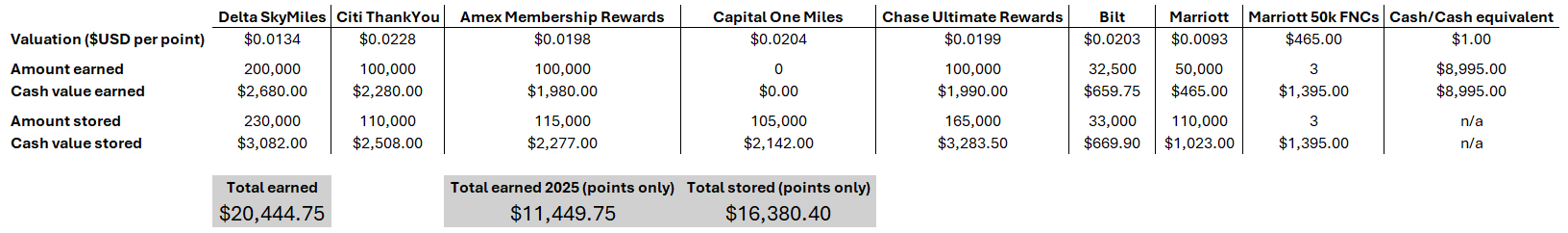

Here’s how much I earned from churning, by the numbers:

| Currency | Earned from bonuses in 2025 | End of 2025 balance (approximate) |

|---|---|---|

| Delta SkyMiles | 200,000 | ~230,000 |

| Citi ThankYou points (TYPs) | 100,000 | ~110,000 |

| American Express Membership Rewards points (MRs) | 100,000 | ~115,000 |

| Capital One Miles | 0 | ~105,000 |

| Chase Ultimate Rewards points (URs) | 100,000 | ~165,000 |

| Bilt points | 32,500 | ~33,000 |

| Marriott points | 50,000 | ~110,000 |

| Marriott 50k free night certificates | 3 | 3 |

| Cash or cash equivalent | $8,995 | |

| Total | 732,500 points + $8,995 | ~1.02 million points |

This is a lot of big numbers, but let’s put it into perspective. What are all these points worth in terms of $USD? I did some analysis to quantify.

Clearly, churning has had outsized value for me. Earning $20,444.75 this year essentially passively and with minimal cost is wonderful ROI!

It’s important to note that this figure only includes earnings from sign-up bonuses, not any points I’ve earned from day-to-day purchases, which I’d estimate represents an additional ~100,000 points across all issuers. I also never spend any money I wouldn’t have otherwise spent in the absence of a sign-up bonus. In other words, I am not spending any extra money to chase these bonuses. I also never carry a balance on any of my credit cards. These are both really important because value from sign-up bonuses is obviously squandered if I’m spending extra money or paying interest at sky-high rates.

What went well in 2025

Taking advantage of all-time-high offers. Nearly all of the credit cards I opened this year had all time high sign-up bonuses, including the Amex Delta SkyMiles Platinum (110k SkyMiles), Chase Sapphire Preferred (100k URs), Amex Gold (100k MRs), and Citi Strata Elite (100k TYPs). Given that many card issuers now have terms of service language allowing only one sign-up bonus per lifetime, I’m glad I was able to maximize my return from limited opportunities to earn bonuses.

Maximizing value from annual fees. I realize it’s not really normal to spend almost $2,000/year on credit card annual fees. But I think I’ve managed to maximize how much value, both cash-equivalent and non-cash-equivalent, I’m getting from these fees. I never want to throw away money in the form of fees. Here are some strategies that worked for me:

- Double dipping: Some credit cards have benefits or credits that reset at the end of every calendar year, which makes it possible to take advantages of these benefits more than once while paying only one annual fee, as long as the card was opened at the right time. For example, I opened a Citi Strata Elite ($595/year) towards the end of the year. This means I can get the $200 calendar-year Best Buy credit three times (2025, 2026, and 2027) while only paying the annual fee once – effectively wiping out the annual fee without even factoring in the card’s other benefits. The same goes for my Delta SkyMiles Gold and Platinum cards ($0/first year and $350/year respectively) which have a calendar-year Delta Stays hotel credit that makes up for most of the annual fee.

- Proactively tracking other benefits: I started using CardPointers to track all the offers available on my cards. This is super helpful for credits that reset monthly, like the Amex Gold’s dining and Uber credits. It helps me make sure that I’m taking advantage of every benefit my annual fee is paying for.

- Creature comforts: The various lounge access passes that several of my cards offer have occasionally been lifesavers while travelling. I take redeyes from the West Coast to the East Coast fairly often, so having access to Chase Sapphire lounges at major airports in the Northeast for a nice meal, drink, and shower in the early morning is wonderful. Also, I fly frequently out of LAX, which has a notorious shortage of lounges and no Priority Pass lounges without a surcharge. So having access to AA Admirals Clubs through my Citi Strata Elite for a quick dinner or drink is a good value-add.

- I’ve also given away my free TSA PreCheck and Global Entry memberships to friends and family 🙂

Leveraging card-linked offers. I’m surprised by how valuable Chase Offers, Amex Offers, and Citi Offers have been for me this year. Part of this is probably because CardPointers can automatically add and index these offers for me so I can easily check if a given merchant I’m shopping at has a card-linked offer available. I’ve gotten $500+ of value this year from the recurring AT&T Fiber offers, as well as various merchant offers I’ve used for buying groups (IYKYK).

GM Rewards MasterCard. This is an interesting card that’s been something of a sleeper hit for me in 2025. I’ve never seen it advertised on any credit card/travel blog (probably because Barclays doesn’t pay referrals lol), but it’s easy to see how this is an awesome card:

- By applying through a GM dealer, I got a $500 rebate thrown into my vehicle lease contract as an extra sign-up bonus

- The GM dealer offer also gives 0% APR for 9 months on GM purchases

- The card earns 10% cashback on GM purchases and 3% on all other purchases (this is higher than possibly any other catch-all card on the market)

I used the card to cover a one-pay car lease that was already ludicrously cheap and offset the price even more. I’m also taking advantage of the 0% APR period to earn interest on the money I otherwise would’ve paid upfront. Let’s just say I got a once-in-a-lifetime deal on a new GM electric vehicle this year, thanks to this card 🙂

The catch is that GM MasterCard points can only be redeemed as a statement credit on GM Financial loans or leases. So this makes the card essentially useless if you aren’t a GM Financial customer, but it works well for me given my existing GM Financial lease.

Rakuten’s surprise partnership with Bilt. Rakuten suddenly making their cashback redeemable for Bilt points in mid-2025 wasn’t on my bingo card, but this has been pretty profitable for me. Besides a bit of regular cashback I’ve earned, Rakuten has some decent sign-up bonuses for various bank accounts. I’m planning to redeem my Rakuten Bilt points for Hyatt stays, but I think I’ll move my Rakuten back to Amex MRs once the Bilt transfer rate halves in mid-2026. I’ve earned enough points through Rakuten for at least a few free nights at a Category 1-5 Hyatt. Of course, that’s assuming Bilt doesn’t go under between now and then.

What could’ve gone better

Starting earlier in the year. Believe it or not, I didn’t open any credit cards in 2025 until May. Part of this was because my credit report wasn’t as thick and aged as it is now, so my risk of getting denials was probably higher earlier in the year. But I think I could have gotten at least a few bonuses during those months I didn’t have any sign-up bonuses in progress.

Opening business cards. I opened my first business cards towards the end of the year, but I think I could have started doing this much sooner. Thanks to some manufactured spend, my aggregate monthly turnover is now high enough that I can meet the minimum spend requirements for many business card bonuses. Plus, I was under 5/24 for most of the year, so I had and missed an opportunity to get on the Chase Ink train before those cards became lifetime restricted towards the end of 2025.

Working harder to avoid denials. Ironically, getting denials is now more of an issue for bank account bonuses than credit card bonuses. I’ve opened so many accounts in the last year that banks sensitive to ChexSystems or EWS inquiries have started denying me regularly. I’ve been able to get around this a little bit by opening in-branch rather than online, but it’s still annoying to deal with. I need to start planning and sequencing my bank account bonuses to prioritize banks that are inquiry sensitive.

Looking ahead to 2026

Overall, I think things are going to get more difficult in 2026. I believe I’ve exhausted many of the “low hanging fruit” type bonuses, so I’ll be ineligible for those easy earnings for several years. I imagine it will be increasingly difficult to find bonuses that a) are lucrative and b) I can get approved for. I’m also concerned about algorithm-based anti-churning rules like Amex’s notorious “pop-up jail” now that I’m ramping up my churning activity. I’m hoping I won’t have to deal with working around those algorithms.

I had a few great points redemptions in 2025 – check out my Travel Year in Review posts for more – but I generally haven’t redeemed very many points, so I’ll have plenty to use in 2026. I’m especially excited to redeem my Marriott Free Night Certificates before they expire in the summer – I’m eyeing some nicer hotels in Japan that fit right under the 50k FNC cap. My schedule will stay very flexible for at least the first half of 2026 so I’m definitely planning many more trips. I also want to fly business and first class more often. My goal: Burn all of my points in 2026!

Another big change I anticipate is that I’ll be starting my full-time work towards the end of 2026. This will obviously reduce my ability to travel a lot, another reason why I want to use up all my points. I expect that the time and energy I’ll be able to devote to churning will also decrease. However, I will be working in a travel-heavy role in a travel-heavy industry, so I’ll have plenty of status matches and organic points earning opportunities to capitalize on. Unfortunately, corporate cards are now mandatory for my company, but at least my corporate card earns 1x Amex MRs on everything (and our corporate spend is…very, very high).

I also have a handful of card-specific plans:

- Chase Marriott Bonvoy Boundless: I originally opened this card with the intent of upgrading to the Ritz-Carlton Card, which is basically a Sapphire Reserve but better and cheaper. I’ll be eligible to do that upgrade in mid-2026.

- Citi Strata Elite, Amex Delta SkyMiles Gold, Amex Delta SkyMiles Platinum: I opened these cards solely for the sign-up bonus and triple dip opportunities. Triple dip means the annual fees for these cards are undoubtedly worth it for the first year, but I don’t think I would renew these cards. The only one I might consider keeping is the SkyMiles Platinum card, whose annual fee could be made up for by the annual Delta Stays credit and the Companion Certificate. I would probably close the SkyMiles Gold and downgrade the Strata Elite to another Citi card.

- Amex Delta SkyMiles cards: Delta is my airline of choice given the routes I fly the most are Delta hub-to-hub. If (when) Amex has another series of no lifetime language card offers like the ones I got this year, I’ll definitely apply to refill my SkyMiles balance.

Unlike credit cards, I don’t think I’ve ever actually kept a bank account open long after getting its bonus. I don’t anticipate changing this in 2026, so I have no bank account-specific plans.

Bottom line and my advice

I’m really satisfied with the value I’ve gotten from churning credit cards and bank accounts this year. Though I track my churning activities individually, I rarely aggregate the numbers to the degree that I did for this post. Frankly, I was positively surprised to see that my churning income represents a non-negligible portion of my annual income. I can confidently say that churning is the main reason I could travel as much as I did in 2025. I’m grateful to enjoy this hobby that lets me access the wonderful travel experiences I’ve had this year, and I’m looking forward to what new opportunities arise in 2026.

If you’re interested in joining the churning club, consider that churning is, admittedly, a time- and energy-consuming hobby. It takes a certain level of attention to detail to make sure you’re applying for the right bonuses and meeting the requirements for each one. I like my tracking spreadsheets and to-do lists, so this works for me, but it’s understandably not for everyone. However, my opinion is that if you’re not churning, ignore influencers and don’t open travel credit cards, especially expensive ones! Influencers and certain travel blogs earn a lot of money from promoting certain cards. The reality is: many points redemptions, especially good redemptions, require so many points that it would take an incredibly long time to amass those points through regular spend without large bonuses. That spend would almost certainly get better ROI if it was put on a good cashback credit card and earned straight cash instead.